BTC Price Prediction: Will Bitcoin Reach $200,000 Amid Market Crosscurrents?

#BTC

- Technical Resilience: BTC holds above 20-day MA and key support at $115K, but MACD remains bearish.

- Institutional Dichotomy: Corporate treasury accumulation vs. Galaxy's massive sale creates conflicting fundamental signals.

- Price Targets: $122K (Bollinger upper band) is the immediate hurdle; $200K would require breaking historical growth patterns.

BTC Price Prediction

BTC Technical Analysis: Key Indicators to Watch

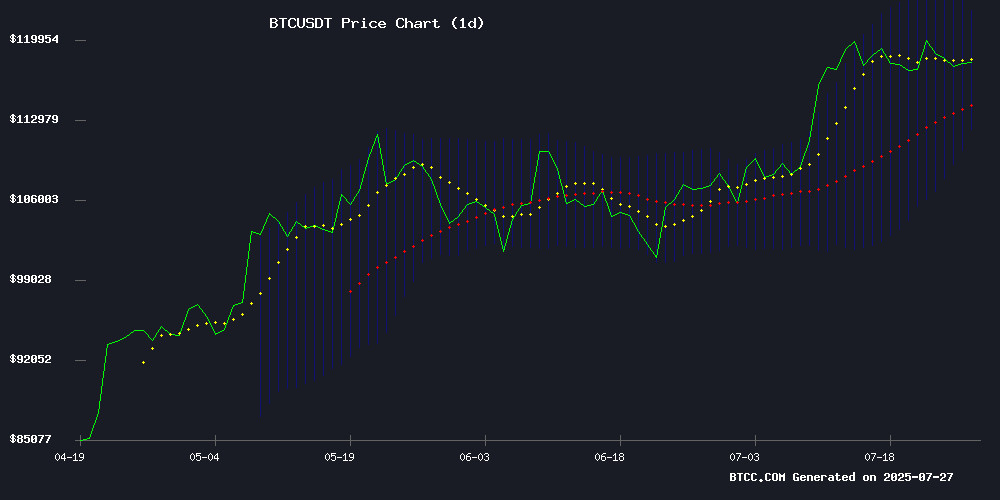

According to BTCC financial analyst Emma, Bitcoin (BTC) is currently trading at 117,871.68 USDT, slightly above its 20-day moving average (MA) of 117,323.81. The MACD indicator shows a bearish crossover but with a narrowing gap (-2485.49 vs. -4353.52), suggesting potential momentum shifts. Bollinger Bands indicate a tight range between 112,116.24 (lower band) and 122,531.38 (upper band), with the middle band at 117,323.81. Emma notes that holding above the 20-day MA could signal short-term bullishness, but a break below the lower band may trigger further downside.

Market Sentiment: Mixed Signals for Bitcoin

BTCC financial analyst Emma highlights conflicting narratives in Bitcoin's news flow. While institutional activity and corporate treasury accumulation (e.g., Galaxy's $9B sale debate) support long-term price speculation ($1M targets), bearish social signals and resistance at $118K create near-term uncertainty. Emma cautions that aggressive selling pressure contrasts with Bitcoin's ability to hold key supports ($115K-$118K), creating a 'wait-and-see' sentiment among traders.

Factors Influencing BTC’s Price

Galaxy’s $9 Billion BTC Sale Sparks Debate on Bitcoin’s Future

Galaxy Digital facilitated the sale of over 80,000 BTC—worth approximately $9 billion—on behalf of an early Bitcoin investor. The transaction, tied to estate planning, was executed via carefully managed OTC deals to avoid market disruption. The scale has ignited speculation about whether Bitcoin’s earliest adopters are losing conviction.

Crypto analyst Scott Melker stoked the debate, suggesting on X that long-term holders may be capitulating. The MOVE underscores tensions between Bitcoin’s ideological roots and the financial realities of large-scale asset management.

Bitcoin Endures Aggressive Selling Pressure While Holding Key Support Levels

Bitcoin weathered one of its most intense bearish weeks in the current bull cycle, with prices oscillating between $114,700 and $120,000. Despite heavy profit-taking, the cryptocurrency demonstrated resilience by maintaining critical support levels—a sign of underlying bullish structure.

CryptoQuant analyst Axel Adler noted this week ranks among the top 7% of extreme selling periods in the cycle. Only 12 weeks have seen comparable outflow pressure since the bull market began. The market now watches for either a decisive breakdown or a breakout above the psychological $120,000 barrier.

What makes this consolidation remarkable is the dichotomy between aggressive selling and price stability. Such tension typically precedes volatile movements. Traders across major exchanges await confirmation of the next directional bias, as Bitcoin's ability to absorb this selling pressure could dictate the tempo of the cycle's next phase.

Analysts Predict Bitcoin Treasury Bubble Could Rival Dot-Com Era

Market analysts are drawing parallels between the current bitcoin rally and the dot-com boom, with projections of up to $11 trillion in institutional capital potentially flowing into Bitcoin treasuries. Public companies such as MicroStrategy and Metaplanet are leading the charge, steadily accumulating Bitcoin as a reserve asset.

Financial leaders have raised alarms about U.S. debt risks, bolstering Bitcoin's reputation as digital gold. This sentiment is fueling speculation of a supply-driven price surge. Bitcoin's market capitalization recently surpassed $2.4 trillion, placing it among the world's most valuable assets, yet the rally has been characterized by subdued sentiment compared to previous bull runs.

Swan Bitcoin notes the current market lacks the euphoria typical of past cycles, suggesting this restraint may ironically signal stronger long-term potential. The so-called 'Bitcoin treasury bubble' thesis hinges on growing corporate, institutional, and sovereign adoption over the coming years.

Bitcoin's Quiet Accumulation: Corporate Treasuries Fuel $1M Price Speculation

Bitcoin's recent price stability belies a gathering storm. Trading at $118,000 after recovering from a two-week low, BTC appears calm—but institutional accumulation patterns suggest otherwise. This isn't retail frenzy but calculated corporate strategy.

Swan Bitcoin highlights the unprecedented nature of this bull run: 'This is the least euphoric we've ever seen.' The driver? Algorithmic treasury purchases by corporations and ETFs, systematically removing supply from circulation. When weak hands sell, institutions absorb.

The $1 million price target gains credibility not from HYPE but from cold balance sheet mathematics. As American HODL observes, once boards recognize BTC's strategic reserve potential, competitive adoption could trigger a supply shock dwarfing the dot-com era's demand surges.

80K Bitcoin Whale Identity Uncovered? MyBitcoin Wallets Linked To Recent Transfer

Bitcoin's market volatility intensified as Galaxy Digital executed a historic sale of over 80,000 BTC, worth more than $9 billion. This transaction, one of the largest in crypto history, triggered sharp price swings and speculation about the seller's identity.

CryptoQuant CEO Ki Young Ju revealed the transferred coins had been dormant for 14 years, originating from wallets tied to the defunct MyBitcoin platform. The reactivation of these early-era coins has sparked debate over whether the original owner—a potential early miner or hacker—was involved.

Market participants are closely monitoring Bitcoin's price action and institutional behavior for signals on its next move. The transaction's timing and scale could prove pivotal for BTC's short-term trajectory.

Bitcoin Faces Resistance at $118K Amid Bearish Social Signals

Bitcoin's rally shows signs of fatigue as it struggles to hold above $118,000, with on-chain metrics flashing caution. The cryptocurrency dipped 4.24% from its $123,091 peak, though such pullbacks remain common during bull markets. Historical patterns suggest deeper corrections—like 2021's 50% retracement—often precede new highs.

Exchange whale ratios now sit at 0.52, a level historically associated with short-term downturns. Long liquidations recently accelerated selling pressure, briefly pushing BTC to $115,000 before a partial recovery. 'When whales move coins to exchanges, it's typically a prelude to distribution,' noted one CryptoQuant analyst.

Bitcoin Price Faces Potential Drop to $109,000 Amid Bearish Chart Pattern

Bitcoin's price action has been notably indecisive over the past week, oscillating between $117,000 and $120,000 before tumbling to $115,000. The decline followed significant coin movements to centralized exchanges, sparking concerns of further downside.

Chartered Market Technician Aksel Kibar warns of a potential drop to $109,000, citing an inverse head-and-shoulders pattern on the weekly chart. This technical formation, typically a bullish signal when the neckline is breached, now suggests a bearish reversal for BTC. Market sentiment appears fragile as traders weigh the risk of an extended decline.

Bitcoin Holds Steady Above $118K as Institutional Activity Drives Market

Bitcoin continues its bullish trajectory, trading above $118,000 with a 1.45% daily gain and a 10.42% rise over the past month. Year-to-date, BTC has surged over 26%, bolstered by institutional demand and a historic on-chain milestone. Glassnode reports bitcoin's realized capitalization—a measure valuing coins at their last transaction price—has eclipsed $1 trillion for the first time, signaling deepening market liquidity and strong holder conviction.

July's price action saw BTC rebound from a low of $105,400 to a record $122,700, triggering profit-taking but also attracting fresh capital. Galaxy Digital's execution of a $9 billion BTC transaction—one of the largest ever—highlights institutional momentum. Meanwhile, Tesla's 2022 decision to divest 75% of its bitcoin holdings remains contentious; retaining those coins WOULD now position the company with over $5 billion in unrealized gains.

Germany's sale of 50,000 seized BTC at approximately $57,900 each has drawn criticism, as those assets would now be worth $5.24 billion. Market participants argue the premature liquidation suppressed prices and forfeited substantial upside.

Bitcoin Price Holds Above $115,000 — Key On-Chain Support in Focus

Bitcoin's rally faces a critical test as prices hover above $115,000, a level marked by sparse on-chain activity but underpinned by robust demand below. The cryptocurrency's abrupt pullback from July's $123,000 peak has traders scrutinizing UTXO data for signals of future direction.

Crypto analyst Burak Tamaç identifies a supply distribution void between $110,000-$115,000, creating a potential inflection point. This thin trading history contrasts sharply with the dense cluster of investor activity at $90,000-$110,000—a zone likely to provide substantial support if tested.

The URPD metric reveals where Bitcoin's real battle lines are drawn. With minimal historical transactions at current levels, the market stands at a crossroads: either consolidate above this untested territory or retreat toward firmer footing where accumulated positions await.

Will BTC Price Hit 200000?

Emma of BTCC suggests that while Bitcoin's technicals show resilience (trading above the 20-day MA and key on-chain support at $115K), reaching $200,000 would require a 70% surge from current levels. The table below summarizes critical thresholds:

| Indicator | Level | Implication |

|---|---|---|

| 20-day MA | 117,323 USDT | Short-term trend support |

| Bollinger Upper | 122,531 USDT | Next resistance |

| MACD Histogram | +1,868 | Bullish momentum building |

News-driven volatility (e.g., whale movements, treasury bubbles) could accelerate momentum, but Emma emphasizes patience: 'The Dot-Com-era-like speculation needs institutional confirmation to sustain a rally beyond $150K.'